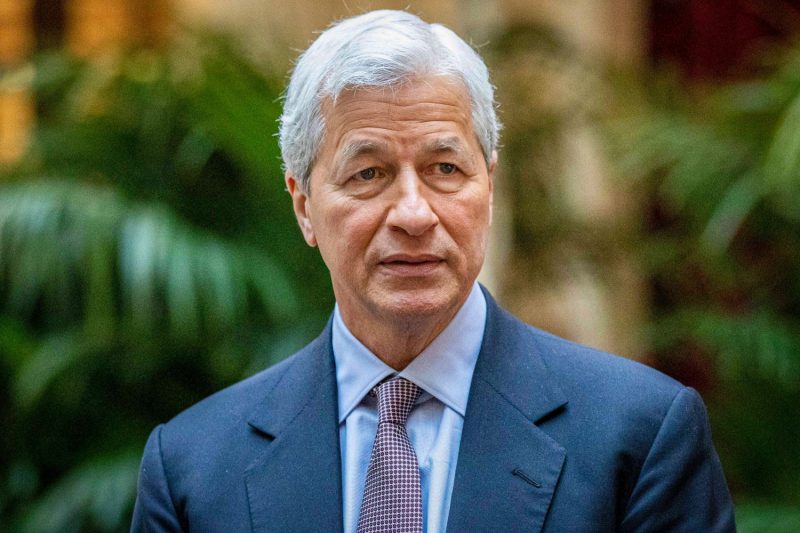

JPMorgan Chase CEO Jamie Dimon said Wednesday that the looming tariffs that President Donald Trump is expected to slap on U.S. trading partners could be viewed positively.

Despite fears that the duties could spark a global trade war and reignite inflation domestically, the head of the largest U.S. bank by assets said they could protect American interests and bring trading partners back to the table for better deals for the country, if used correctly.

“If it’s a little inflationary, but it’s good for national security, so be it. I mean, get over it,” Dimon told CNBC’s Andrew Ross Sorkin during an interview at the World Economic Forum in Davos. “National security trumps a little bit more inflation.”

Since taking office Monday, Trump has been saber-rattling on tariffs, threatening Monday to impose levies on Mexico and Canada, then expanding the scope Tuesday to China and the European Union. The president told reporters that the E.U. is treating the U.S. “very, very badly” due to its large annual trade surplus. The U.S. last year ran a $214 billion deficit with the E.U. through November 2024.

Among the considerations are a 10% tariff on China and 25% on Canada and Mexico as the U.S. looks forward to a review on the tri-party agreement Trump negotiated during his first term. The U.S.-Mexico-Canada Trade Agreement is up for review in July 2026.

Dimon did not get into the details of Trump’s plans, but said it depends on how the duties are implemented. Trump has indicated the tariffs could take effect Feb. 1.

“I look at tariffs, they’re an economic tool, That’s it,” Dimon said. “They’re an economic weapon, depending on how you use it, why you use it, stuff like that. Tariffs are inflationary and not inflationary.”

Trump leveled broad-based tariffs during his first term, during which inflation ran below 2.5% each year. Despite the looming tariff threat, the U.S. dollar has drifted lower this week.

“Tariffs can change the dollar, but the most important thing is growth,” Dimon said.

Dimon wasn’t the only Wall Street CEO to speak of tariffs in a positive light.

Goldman Sachs CEO David Solomon, also speaking to CNBC from Davos, said business leaders have been preparing for shifts in policy, including on trade issues.

“I think it turns into a rebalancing of certain trade agreements over time. I think that rebalancing can be constructive for U.S. growth if it’s handled right,” Solomon said. “The question is, how quickly, how thoughtfully. Some of this is negotiating tactics for things over than simply trade.”

“Used appropriately, it can be constructive,” he added. “This is going to unfold over the course of the year, and we have to watch it closely.”